The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• The 25 most powerful ideas of the 21st century (so far), picked by the world’s top thinkers: We asked the world’s foremost minds to highlight some of the game-changing scientific breakthroughs shaping our world since the year 2000. (BBC Science Focus Magazine)

• Breaking Burry: Totally perverse unnatural massive market distortions: 1, Michael Burry: 0. One major headline today is that Michael Burry, of The Big Short fame, is shuttering his fund, Scion Capital. In his letter calling it quits, he wrote: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” I’ve been around markets long enough to believe that short sellers are generally more objectively right than most investors. (QRT’s Fringe Finance)

• Kicking Robots: Humanoids and the tech-industry hype machine: Kicking robots is something of a pastime among roboticists. Although the activity generates anxiety for lay observers prone to worrying about the prospect of future retribution, it also happens to be an efficient method of testing a machine’s balance. (Harper’s Magazine)

• How to Sound Like an Expert in Any AI Bubble Debate: There are 12 statistics, factoids, and studies that dominate every discussion about whether artificial intelligence is a bubble. Here’s a deep-dive into all 12 arguments. (Derek Thompson) see also Large Language Mistake: Cutting-edge research shows language is not the same as intelligence. The entire AI bubble is built on ignoring it. (The Verge)

• The new politics of autism: Autism — a neurodevelopmental disability — has become a political issue. How did this happen? As contentious claims over rising diagnoses get a presidential platform, Simon Baron-Cohen explains where talk of an ‘epidemic’ goes wrong — and why we need more recognition that autism comes in different forms. (Financial Times)

• How to Fix a Typewriter and Your Life. “It’s like Zen,” Lundy says about those hours at the bench. “There are times when it is just very relaxing to be standing in front of the machine and slowly cleaning it, tweaking the adjustment so visually things start to really line up.” (New York Times)

• America’s Polarization Has Become the World’s Side Hustle: The ‘psyops’ revealed by X are entirely the fault of the perverse incentives created by social media monetization programs. (404) see also Elon Musk’s Worthless, Poisoned Hall of Mirrors: How X blew up its own platform with a new location feature. (The Atlantic)

• The Strange and Totally Real Plan to Blot Out the Sun and Reverse Global Warming: A 25-person startup is developing technology to block the sun and turn down the planet’s thermostat. The stakes are huge — and the company and its critics say regulations need to catch up. (Politico)

• The realities of being a pop star, according to charli xcx. One of the main realities of being a pop star is that at a certain level, it’s really f*cking fun. You will also end up spending a lot of time inhabiting strange and soulless liminal spaces. (charli’s substack)

• Stephen Colbert on the End of The Late Show: In an exclusive exit interview, the late-night host reflects on how he learned about the cancellation of The Late Show, how he plans to make the most of the rest of his time in the seat, and what he’ll do next. (GQ)

Be sure to check out our Masters in Business interview this weekend with Wilhelm Schmid, CEO of famed watchmaker A. Lange & Söhne, the Glashütte, German watchmaker, recorded live at the Audrain Newport Concours d’Elegance.

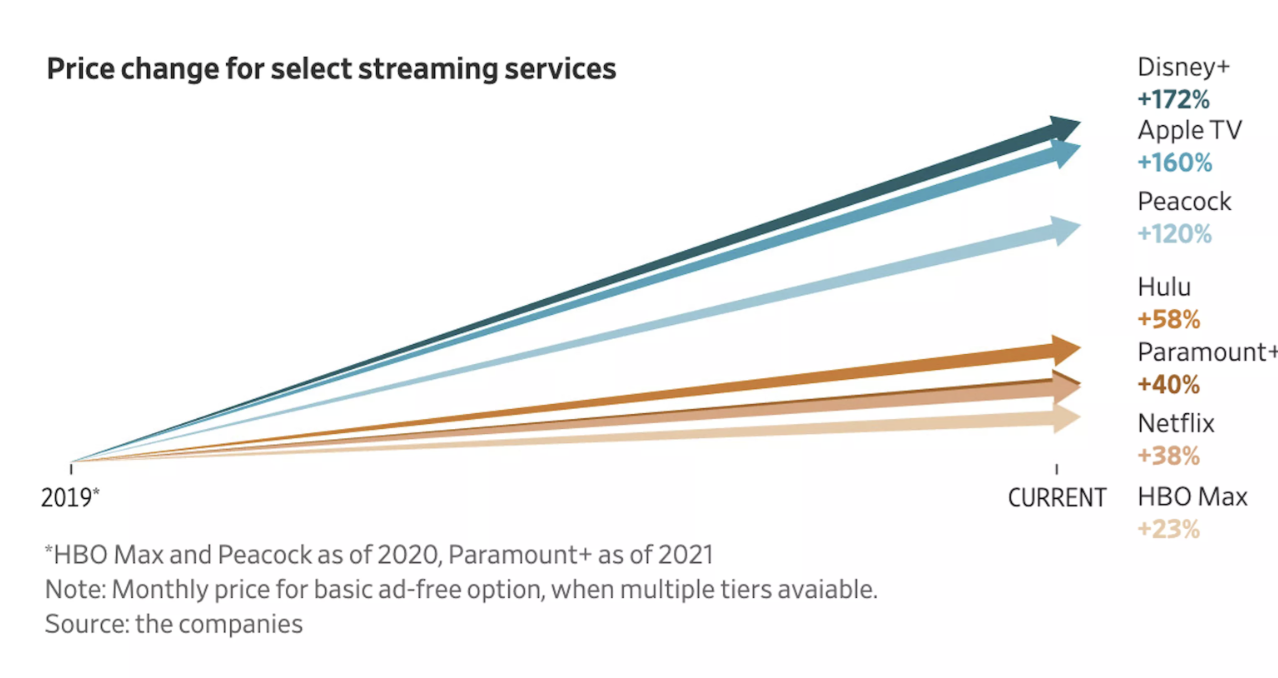

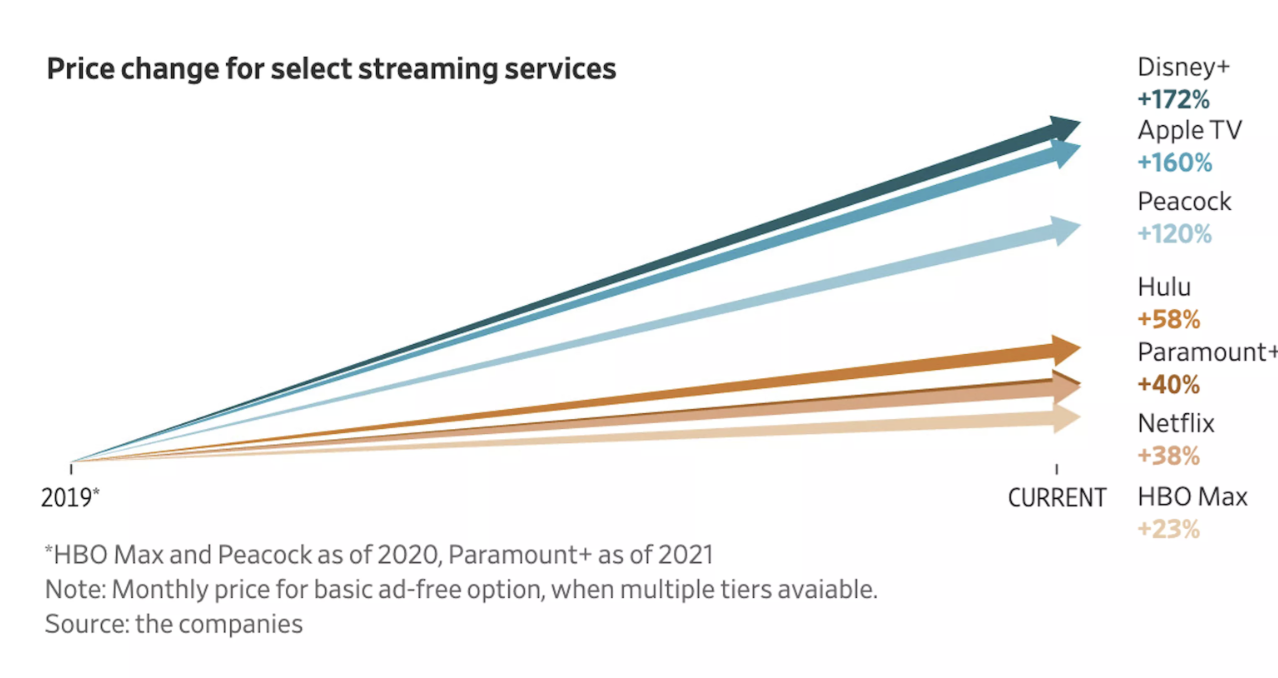

Streamflation intensifies as Netflix, Disney+, et. al. continue raising prices

Source: Techspot

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.