The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• The Era Of The Business Idiot: We live in the era of the symbolic executive, when “being good at stuff” matters far less than the appearance of doing stuff, where “what’s useful” is dictated not by outputs or metrics that one can measure but rather the vibes passed between managers and executives that have worked their entire careers to escape the world of work. Our economy is run by people that don’t participate in it and our tech companies are directed by people that don’t experience the problems they allege to solve for their customers, as the modern executive is no longer a person with demands or responsibilities beyond their allegiance to shareholder value. (Where’s Your Ed At?)

• Buy-Side Quant Job Advice: Now, let’s really start. If you are of legal age and are into it, now is an excellent time to grab a stiff drink. (Consumed by fire)

• Appreciation for Air Jordans: 40 shoes, 40 years, multiple stories to tell: There was a time when the Air Jordan shoe was a basketball-only staple. The best ballplayers — whether scoring buckets in an NBA arena, a fitness gym or even a popular blacktop court outdoors — would have the shoes draped around their necks, shoelaces tied together. Somewhere down the road, those shoes began living a double life. They became lounging kicks. (New York Times)

• Your Key Survival Skill for 2026: Critical Ignoring: In an age of endless low-quality information, it’s time to fight our instinct to seek out and absorb all we can. It takes practice. (Wall Street Journal)

• Why does something exist instead of nothing? Perhaps the most remarkable fact about the Universe is simply that it, and everything in it, exists. But what’s the reason why? (Starts With A Bang) see also Reality is evil: Everything eats and is eaten. Everything destroys and is destroyed. It is our moral duty to strike back at the Universe. (Aeon)

• The U.S. may have a secret weapon against rising electricity prices: Most of the year, grid utilization is around 50 percent. Could that be used to lower prices? (Washington Post)

• ‘I Was Just So Naïve’: Inside Marjorie Taylor Greene’s Break With Trump: How the Georgia congresswoman went from the president’s loudest cheerleader to his loudest Republican critic. (New York Times) see also What makes something a cult? Here is what our data say . (Clearer Thinking)

• Why Everyone Loves Japan Part III of my book on the Japanese economy. (Noahpinion)

• The triumph of logical: English prose has become much easier to read. But shorter sentences had little to do with it. (Works in Progress) see also The Lost Art of Research as Leisure: Where have the amateur researchers gone, and how do we bring them back? (Kasurian)

• The Inconceivable Start to Rob Reiner’s Legendary Movie Career: The director began with a hot streak of seven movies in eight years, including perhaps his most beloved of all: ‘The Princess Bride.’ (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Stephanie Drescher, Apollo’s Chief Client and Product Development Officer. She oversees everything from the global wealth business to portfolio management, product development, and client marketing. She is a member of the firm’s leadership team. Since 2020, Barron’s has named her annually to its list of the 100 Most Influential Women in U.S. Finance.

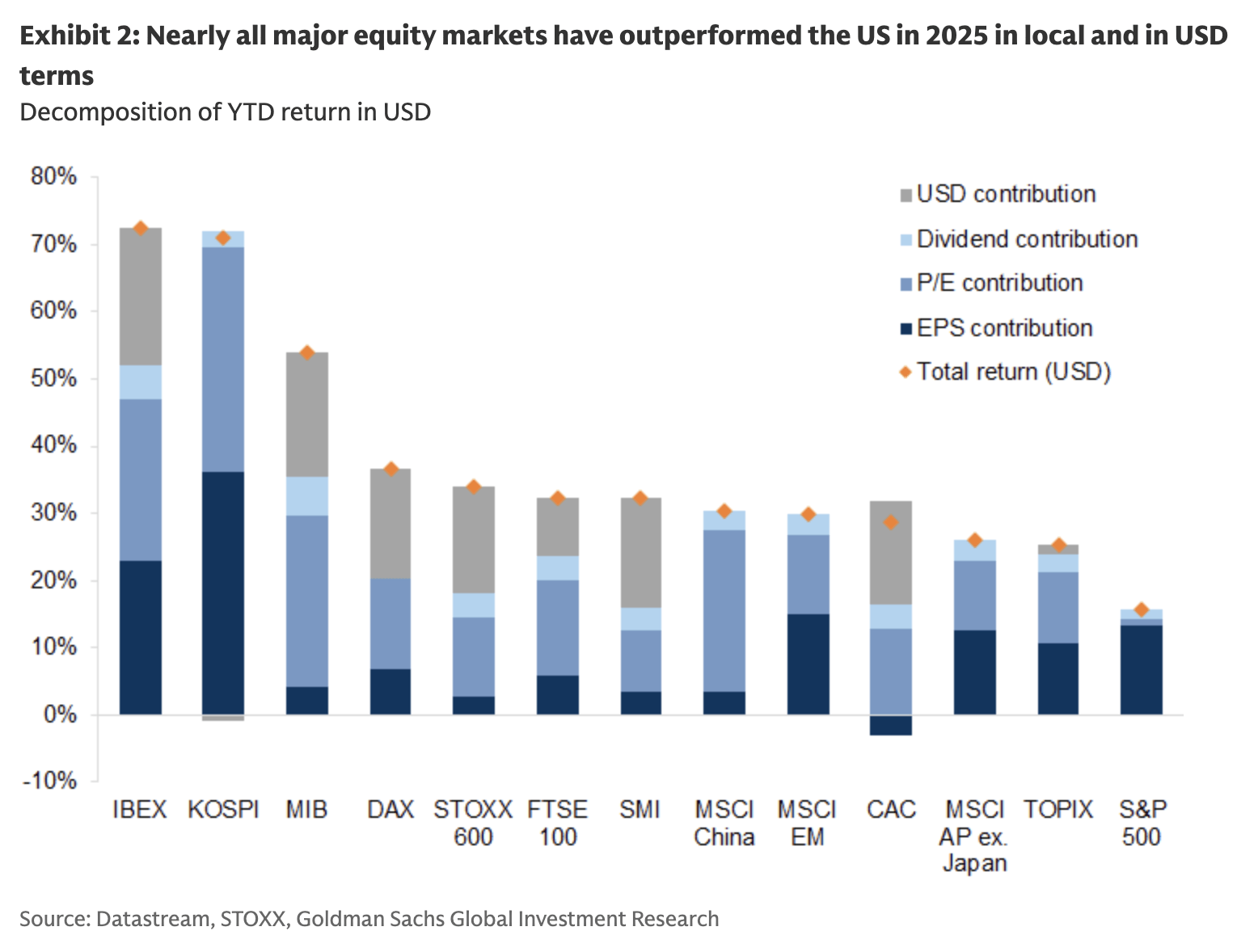

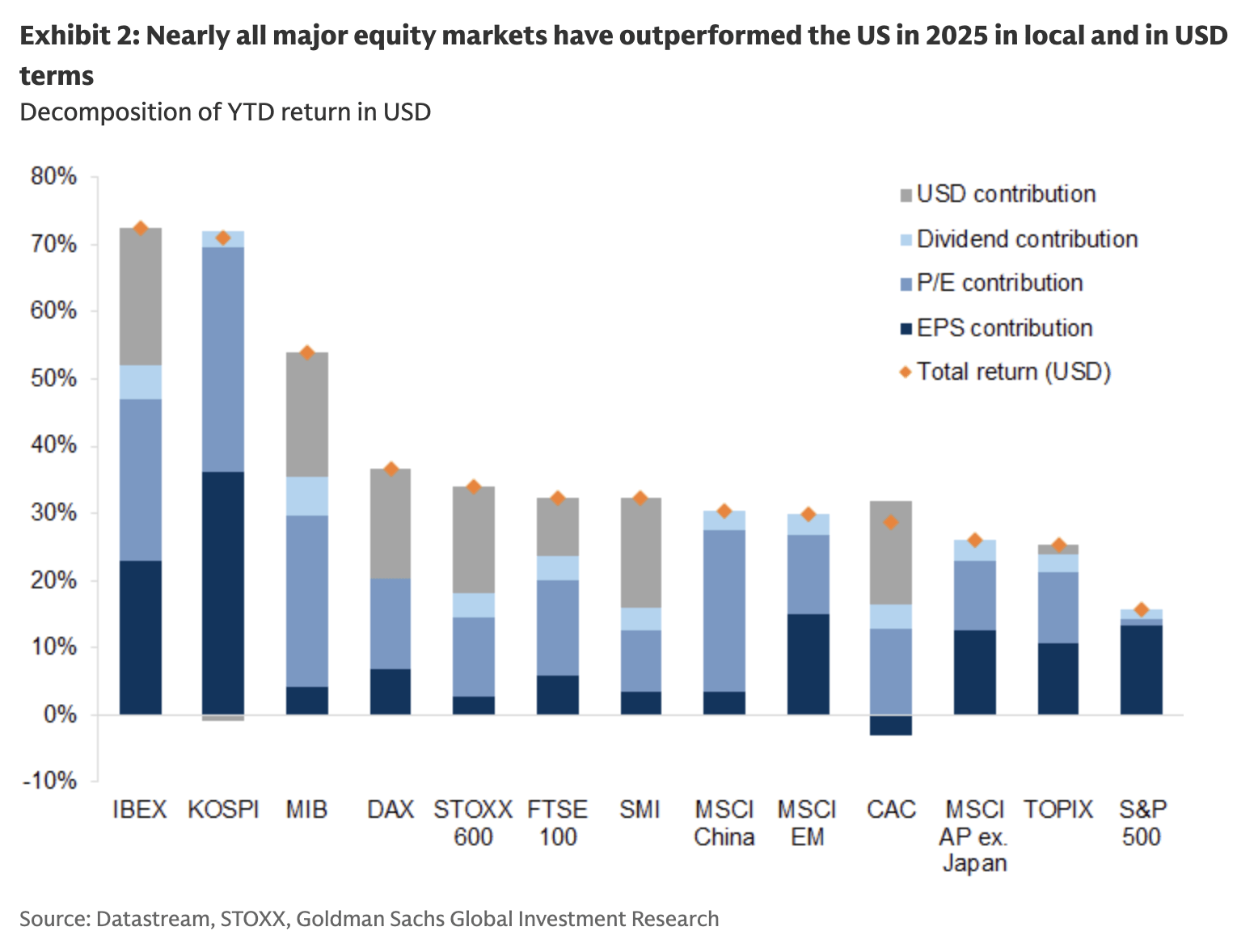

Equities outside the US outperformed this year for the first time in awhile; its not entirely a dollar story

Source: @bobeunlimited

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.