My end-of-week morning train WFH reads:

• Even Permabears Have Portfolios. Where Jeremy Grantham Sees Value Now. The veteran investor and co-founder of GMO likes quality stocks, international value, and Japan. (Barron’s)

• Beauty Has Never Been More Cutthroat. Here’s How Sephora Plans to Stay on Top. Executives at the LVMH-owned retailer offer a rare look inside the company’s strategy. (Wall Street Journal)

• More Than 1,000 Companies Are Suing Trump Over His Tariffs. Companies are flocking to challenge the administration’s import taxes in court, after the Supreme Court started asking tough questions. (Bloomberg)

• The data center rebellion is here, and it’s reshaping the political landscape: As the buildout of AI infrastructure alarms communities, it is fast emerging as a potent electoral issue across the political divide. (Washington Post)

• 25 Lessons on Money and Meaning: Notes from everything I’ve learned so far about the deeper forces behind our financial lives (The Root of All)

• Rubio Has Long Dreamed of Changing Latin America. Embracing MAGA Opened the Door. Once a Trump critic, the secretary of state has become one of the president’s closest advisers. (Wall Street Journal) see also Dateline: Caracas: Venezuela’s Democratic Roots Deeper Than Trump Knows (or Cares) (Intrinsic Value by Roger Lowenstein)

• AI and the Human Condition. OpenAI may or may not be the most important company of the future. From the day it was founded — with a non-profit corporate structure that sought to build AGI and then control it themselves “to ensure artificial general intelligence benefits all of humanity” — this company has divided the audience and invited either passionate support or aggressive eye-rolls. (Stratechery)

• The most volatile group of voters is turning on Trump: There’s a new line dividing young Americans. (Vox) see also Is the Future of MAGA Anti-Israel? For 40 years, Christian Zionism was a powerful force in American politics. A new generation on the right is taking cues from elsewhere. (New York Times)

• Among the Prophets: Science fiction and the art of prediction. (The Baffler)

• Terrence Malick’s Disciples: Why the auteur is the most influential director in Hollywood (The Yale Review)

Be sure to check out our Masters in Business interview this weekend with Ben Hunt, founder of Perscient, a firm that studies how narratives and stories shape markets, investing, and social behavior through the lens of information theory, game theory, and unstructured data analysis. His work analyzes the language, story arcs, and viral spread of explanations in media

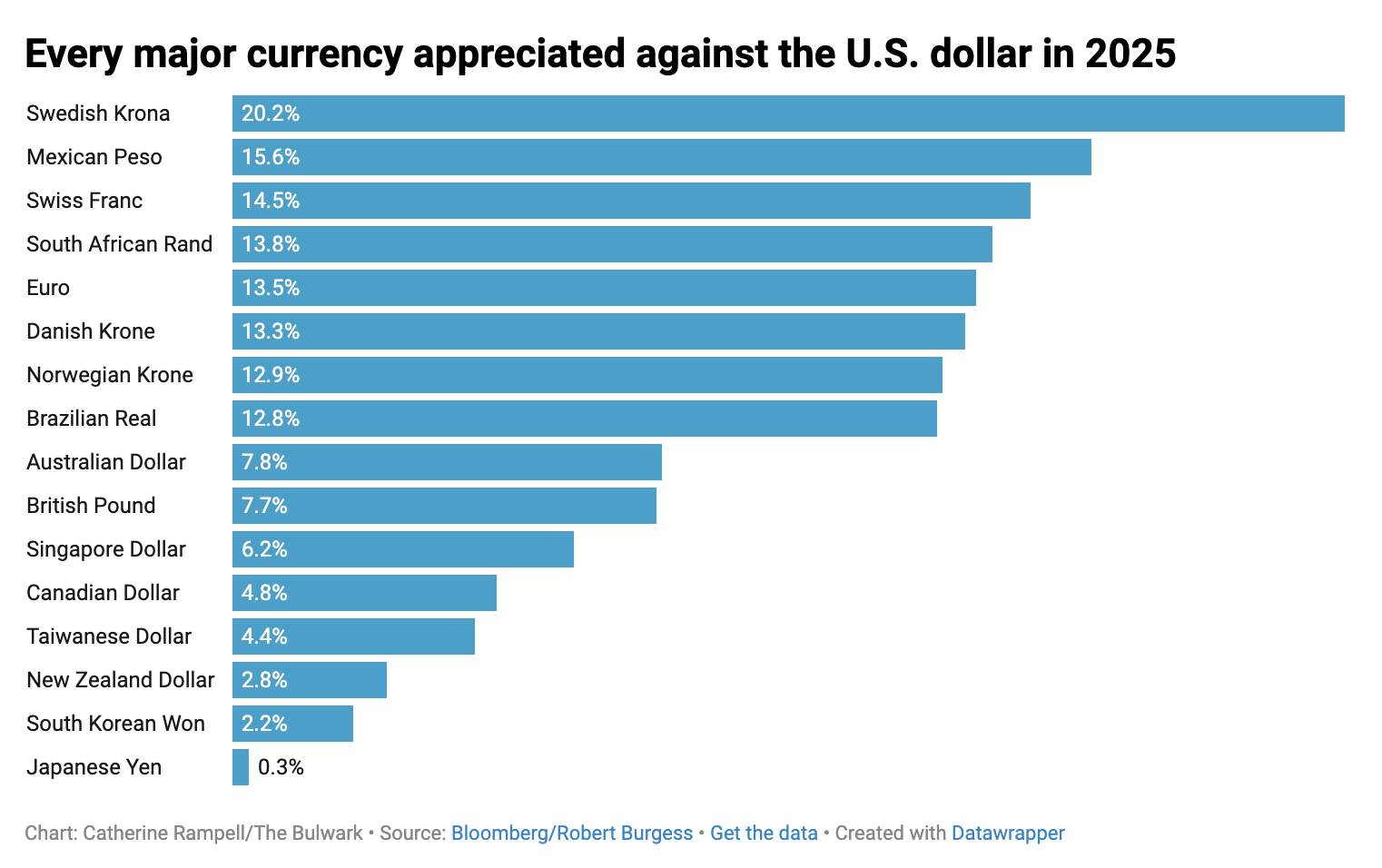

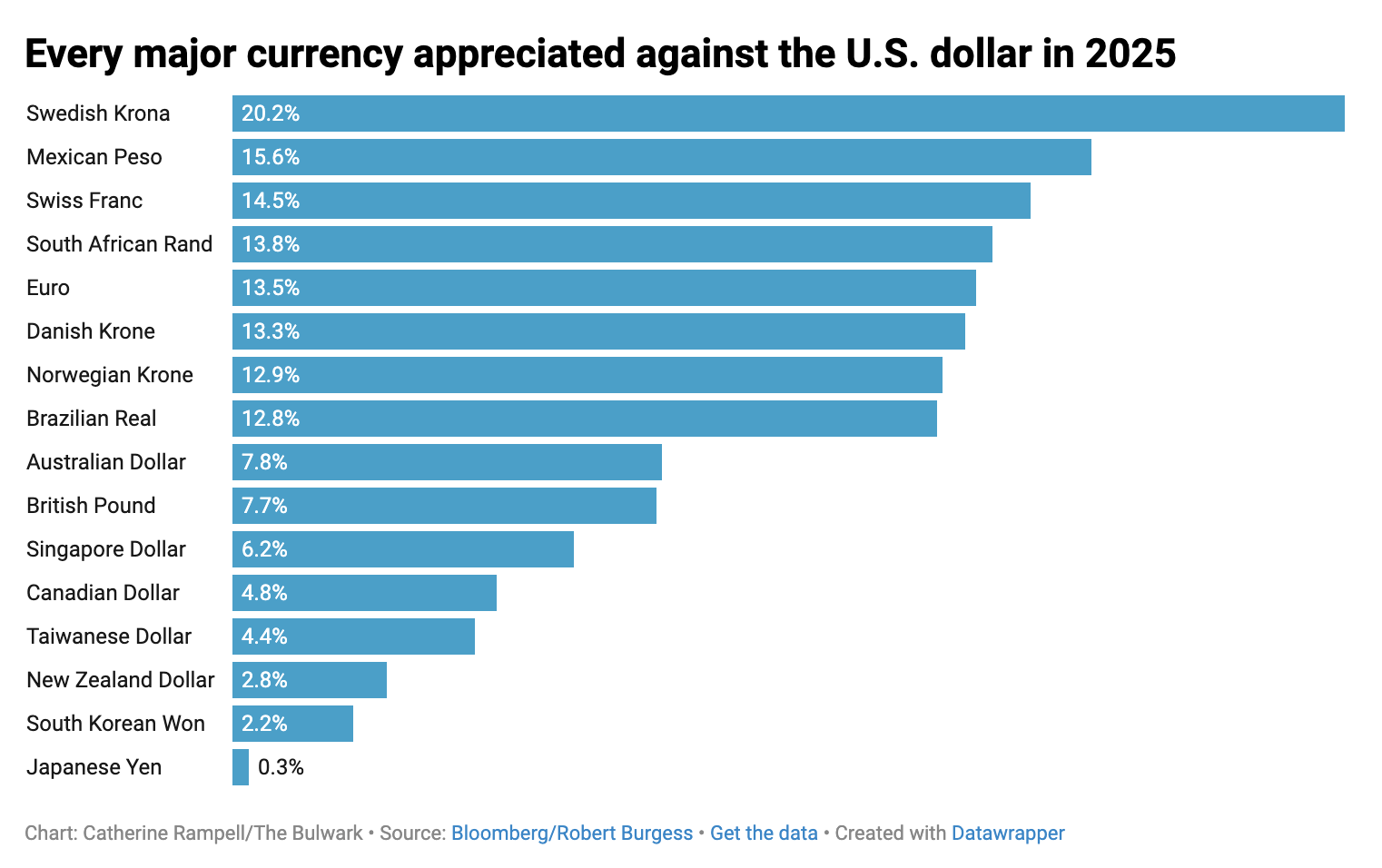

U.S. Dollar is slumping vs other currencies; 2025 was the biggest decline since 2017

Source: The Bulwark

Sign up for our reads-only mailing list here.