The housing market was very affordable with low mortgage rates in the 2010s.

The housing market was relatively affordable in 2020 and 2021 with generationally low mortgage rates in 2020 and 2021.

Since 2022 the housing market has become extremely unaffordable with much higher mortgage rates.

The ramifications of this move seem obvious. Many young people are out of luck if they don’t have help from family money. Lots of homeowners with 3% mortgages on houses that cost a lot less than current values feel stuck. Housing activity remains weak relative to historical standards.

There are also unintended consequences of high housing costs.

New paper from researchers at the University of Chicago and Northwestern dug into the data on how unaffordable housing costs are changing the behavior of young people. There were three big shifts in the data:

1. Consumption: They spend more relative to their wealth.

2. Effort: They reduce their effort at work.

3. Investment: They take on riskier investments.

I’m not sure how they can accurately track effort at work but 1 and 3 both make sense to me.

If you don’t need to save for a down payment or all of the other ancillary housing costs (closing costs, insurance, property taxes, etc.) you have the ability to spend more elsewhere. And if you’re not going to invest in a house it makes sense that young people would shift more of their savings into the stock market and crypto.

The crazy thing is, unless we do something about the lack of housing supply in this country, things could get much worse.

The Financial Times looked at the house price-to-income ratio in London, the UK and the US:

These ratios have obviously gotten worse over time but look at how much more expensive it is in the UK than the US.1

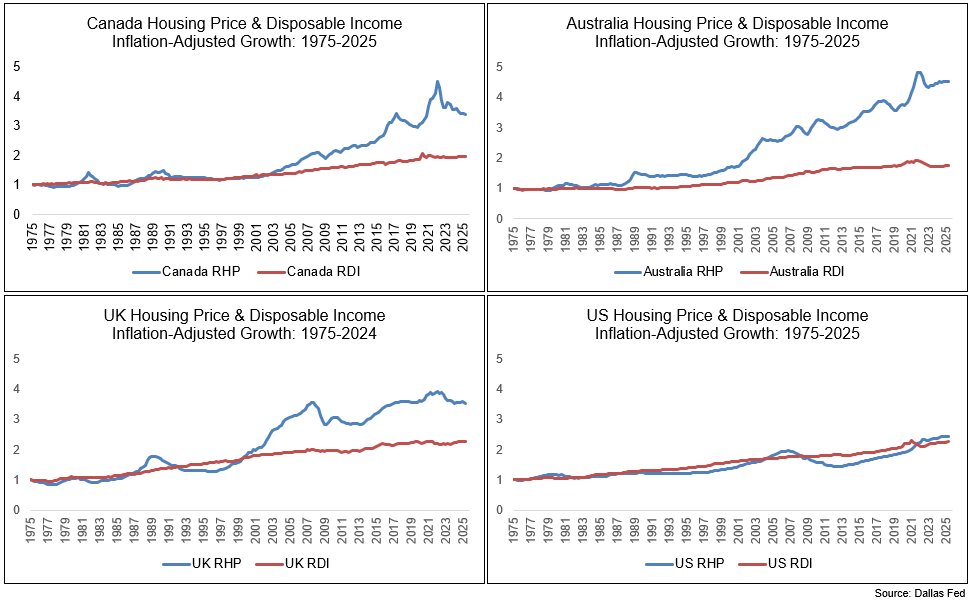

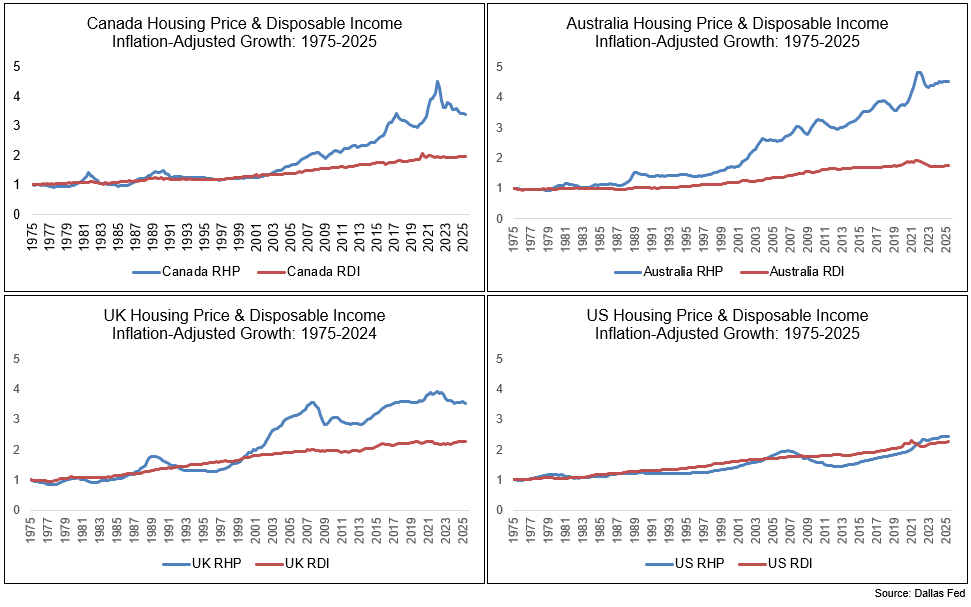

I track housing data from the Dallas Federal Reserve on various countries when it comes to housing prices vs. income growth.

If you compare the United States to other developed countries like the UK, Australia and Canada, things don’t look so bad here (on a relative basis):

(RHP = Real Housing Prices, RDI = Real Disposable Income)

On an inflation-adjusted basis, incomes have more or less kept up with housing prices in America since the 1970s.

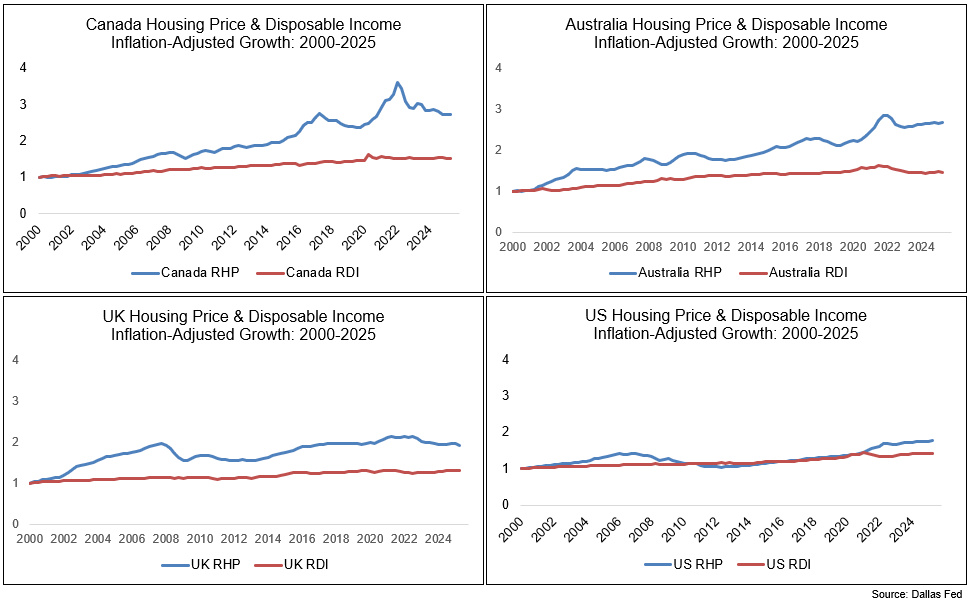

Here’s the data since 2000:

It won’t make you feel any better as a young person in the U.S. to know that it’s even harder for people to afford homes in other countries around the globe.

But these numbers help put things into perspective that things can always get worse.

If the government doesn’t make this a priority the housing affordability crisis likely will get worse in the coming years.

Further Reading:

When Does Housing Become THE Issue?

Michael and I spoke with Logan Mohtashami from Housing Wire about the current state of the housing market and much more on Animal Spirits recently:

1It’s important to note that some of this gap can be explained by the fact that incomes have risen much faster in the US than the UK in recent decades. See here.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.