Komplete Investments LLC

At Komplete Investments, capital management begins with understanding context. Markets change, objectives evolve, and risk is rarely static. Our role is to provide disciplined oversight that adapts to these realities while remaining anchored in long-term priorities. We focus on structure, informed decision-making, and continuity across market cycles so capital is managed with clarity rather than reaction.

We focus on clarity over complexity.

Capital decisions are guided by structure, risk alignment and long term objectives.

Every strategy is built with purpose, patience and measured exposure.

Capital management is not a one-time decision.

Portfolios require ongoing oversight, disciplined adjustments and alignment with changing economic conditions.

Market Perspective

Current markets reward patience more than prediction. Volatility, policy shifts, and global economic pressure have made short-term signals unreliable and reactive decision-making costly. In this environment, capital preservation and measured deployment depend less on timing and more on structure. Understanding how macro forces influence asset behavior over time allows portfolios to remain resilient even when conditions feel uncertain.

At Komplete Investments, market perspective is not built on headlines or forecasts. It is developed through continuous analysis of economic indicators, liquidity conditions, and structural trends that shape risk across cycles. This perspective informs how capital is positioned, adjusted, and protected, ensuring decisions remain grounded in context rather than noise.

Strategic Discipline

Long-term results are rarely the outcome of singular decisions. They are the result of consistent discipline applied across changing conditions. Strategic discipline means knowing when to act, when to wait, and when restraint is the most valuable decision available. It requires frameworks that guide behavior during both opportunity and disruption.

Komplete Investments applies disciplined oversight to ensure capital strategies remain aligned with defined objectives as circumstances evolve. This includes regular evaluation of exposure, thoughtful adjustments when warranted, and continuity in decision-making across market cycles. The goal is not to react faster than the market, but to act with clarity and intention when it matters most.

Komplete Investments Corporate Updates

K.I. approaches growth as a deliberate, structured process — guided by long-term objectives rather than short-term momentum. Each initiative considered by the firm is evaluated through the lens of capital stewardship, operational viability, and strategic alignment. Rather than signaling intent through projections or commentary, K.I. prioritizes action supported by governance, due diligence, and sustained oversight. This approach ensures that expansion reflects readiness and discipline, not acceleration for its own sake.

The updates below highlight recent milestones and active initiatives that demonstrate this philosophy in practice. From governance and information infrastructure to strategic partnerships and sector engagement, these developments reflect measured progress across multiple fronts. Together, they offer insight into how K.I. continues to build responsibly — pairing forward-looking strategy with tangible execution.

Advisory Board

The completion of our advisory board marks a foundational milestone in the firm’s long-term growth strategy. This board was assembled with intention — prioritizing experience, regulatory understanding, and sector depth over visibility or volume. Each advisor contributes specialized expertise across finance, operations, governance, and market analysis, ensuring that decision-making is informed by multiple perspectives and grounded in real-world execution. Rather than serving as a symbolic layer, the advisory board is actively integrated into strategic review, risk assessment, and forward planning initiatives.

This structure allows the firm to remain agile while maintaining institutional discipline. As market conditions evolve and new opportunities emerge, advisory oversight provides a stabilizing framework for evaluation and alignment. The result is a governance model that supports thoughtful expansion, protects capital interests, and reinforces accountability at every level of operation. For clients and partners, this milestone reflects a commitment to measured leadership and sustained excellence — not growth for growth’s sake, but progress guided by experience.

MTD Acqusition

The acquisition of MTD represents a strategic investment in information access, market awareness, and editorial independence. In an environment where financial narratives often prioritize immediacy over accuracy, ownership of a dedicated finance news platform enables a more controlled and thoughtful approach to market intelligence. MTD operates as an independent media property, focused on delivering timely financial coverage, economic insights, and industry analysis without external influence or promotional bias.

Beyond content distribution, the acquisition strengthens internal research capabilities and enhances visibility into emerging financial trends. By maintaining a direct relationship with financial reporting and analysis, the firm deepens its understanding of market sentiment, policy shifts, and economic signals that influence investment decision-making. This alignment between media intelligence and capital strategy reinforces the firm’s emphasis on informed, data-driven oversight — ensuring that investment perspectives remain current, contextual, and strategically grounded.

Transportation Sector Engagement

K.I. is currently engaged in extended discussions with a transportation-focused company as part of a broader evaluation of essential service infrastructure opportunities. These conversations are exploratory in nature and centered on understanding operational frameworks, regulatory environments, and long-term demand stability within the transportation sector. Rather than approaching the space from a speculative or rapid-entry standpoint, K.I. is prioritizing alignment, scalability, and governance considerations before advancing any formal commitments.

Transportation remains a foundational component of economic activity, intersecting with urban development, workforce mobility, and commercial logistics. By maintaining active dialogue with established operators, K.I. continues to assess how capital, oversight, and strategic structure can contribute to sustainable growth in this sector. Any future involvement will be guided by disciplined analysis and measured deployment, ensuring that participation supports long-term objectives and adheres to the firm’s standards for operational readiness and capital stewardship.

Client Value & Approach

Engagement with K.I. begins with an understanding of objectives, constraints, and strategic priorities. Each relationship is evaluated individually to ensure alignment, suitability, and long-term viability. Initial inquiries allow for a focused review of needs and determine whether collaboration is appropriate.

- Capital allocation strategy

- Risk alignment and exposure management

- Portfolio structure and oversight

- Long-term growth planning

- Preservation and continuity considerations

- Market and economic assessment

- High-net-worth individuals

- Private entities and holding companies

- Family offices and generational wealth

- Entrepreneurs with liquidity events

- Clients seeking ongoing oversight

- Capital requiring structured management

Want to expand your message by purchasing ad space on Komplete Investments?

-

10 Wednesday AM Reads – The Big Picture

My mid-week morning train WFH reads: • The brunt of US tariffs — 96% — has been paid by US buyers: A Kiel Institute study found US tariffs are mostly paid by American importers and consumers. The study found foreign exporters paid only around 4% of the tariff cost. The research contradicts Trump’s messaging that […]

-

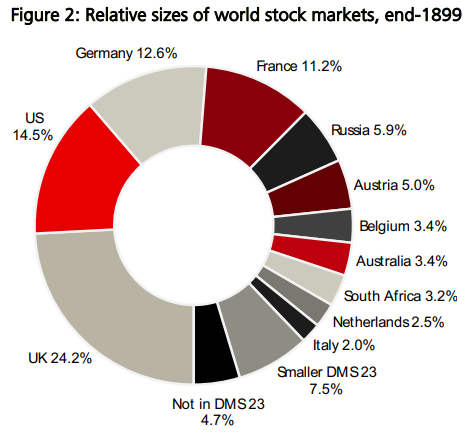

The Winners Write the History Books

I read The World is Flat by Thomas Friedman when it came out in 2005. This was one of the first books I read after graduating college that made me feel smarter. It felt like the world made more sense. Globalization flattened the world. The Internet leveled the global economic playing field. Talent and ideas […]

-

10 Sunday Reads – The Big Picture

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • Is This Billionaire a Financial Genius or a Fraudster? Michael Saylor’s financial alchemy thrust an ordinary software company, Strategy, into the center of the crypto frenzy. It all worked spectacularly, until now. (New York Times) • Banana Republicanism: A criminal investigation of […]

-

How to Fix the Housing Market

No one needs a chart to show housing is unaffordable right now but here are a couple from Apollo anyway: The Trump administration has offered some ideas in recent weeks to help with affordability. The first idea is to ban institutional ownership of homes: The idea here is if you take away demand from professional […]

-

10 Thursday AM Reads – The Big Picture

My morning train WFH reads: • For Years, Powell Avoided Fighting Trump. That’s Over. After receiving grand jury subpoenas Friday, Powell spent the weekend deciding how to respond. By Sunday, he had his answer. (Wall Street Journal) • The golden handcuffs are slipping in the U.S. housing market: For the first time since 2020, the share […]

-

Animal Spirits: Is the Stock Market Invincible?

Today’s Animal Spirits is brought to you by Innovator: This episode is sponsored by Innovator. Learn more at https://www.innovatoretfs.com/pdf/ddq_product_brief.pdf On today’s show, we discuss: Listen here: Charts: Recommendations: Tweets/Bluesky First @BillAckman said capping credit card interest rates was a “mistake” (in a since deleted post). Now he says it’s a “worthy” goal. https://t.co/2MTvgcYXOh pic.twitter.com/WjtMxstt4a — […]

-

It’s Tariff Week! * – The Big Picture

* Hopefully… This is likely the week the Supreme Court issues a ruling on the IEEPA tariffs in place since April 2025 (excluding the 90-day suspension, and other sundry modifications, revisions, pauses, exemptions, etc.). As I noted from the start, this is a deeply flawed policy of questionable legality that was implemented haphazardly (my […]

-

The Probability of Loss in the Stock Market

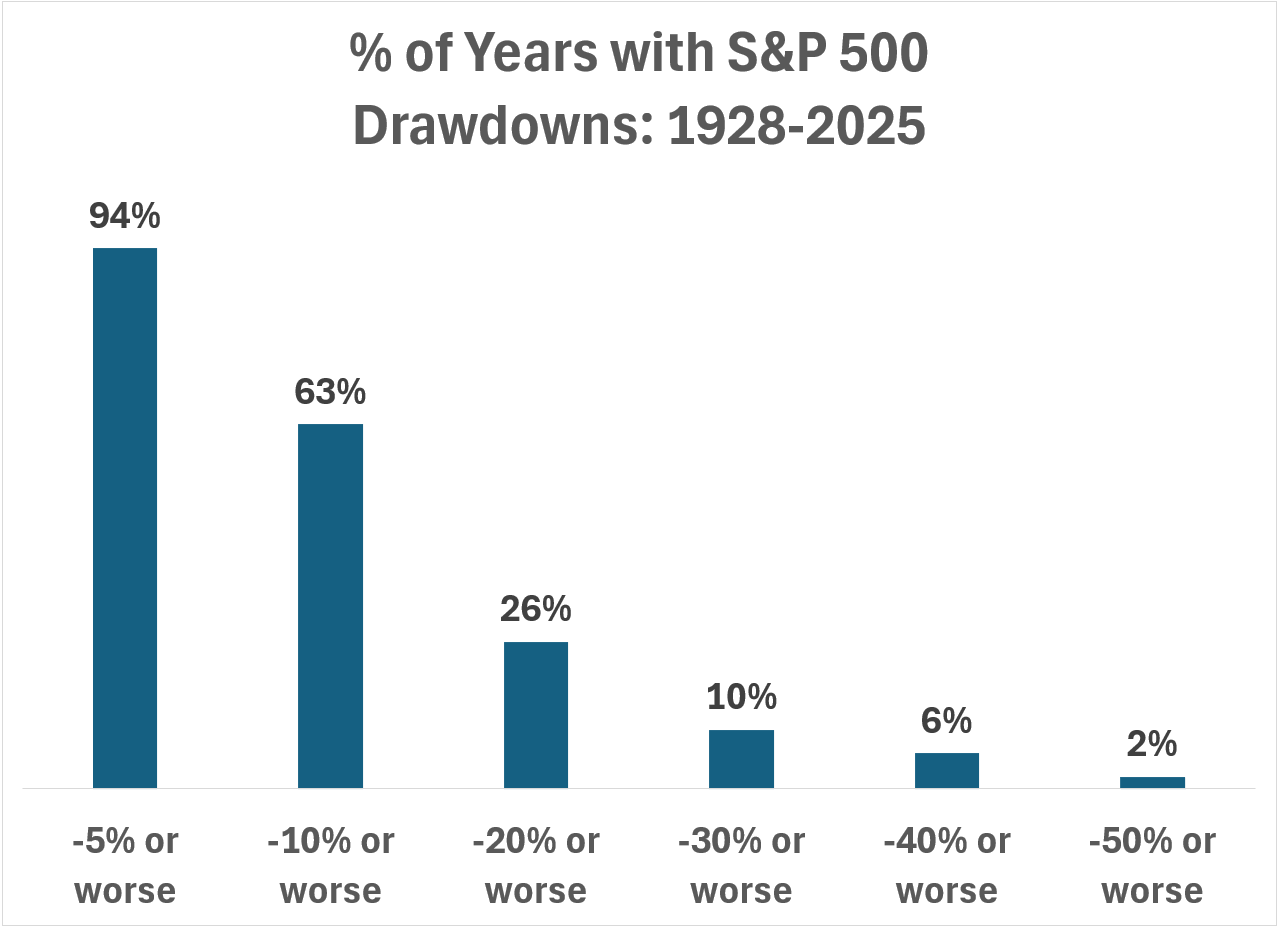

I like playing the odds when it comes to the stock market. I’m a long-term investor because it increases your odds of success. There are no guarantees but the short-term is far more volatile than the long-term. But the odds in the stock market are not static. These things are constantly changing and the results […]

-

10 Friday AM Reads – The Big Picture

My end-of-week morning train WFH reads: • Even Permabears Have Portfolios. Where Jeremy Grantham Sees Value Now. The veteran investor and co-founder of GMO likes quality stocks, international value, and Japan. (Barron’s) • Beauty Has Never Been More Cutthroat. Here’s How Sephora Plans to Stay on Top. Executives at the LVMH-owned retailer offer a rare […]

-

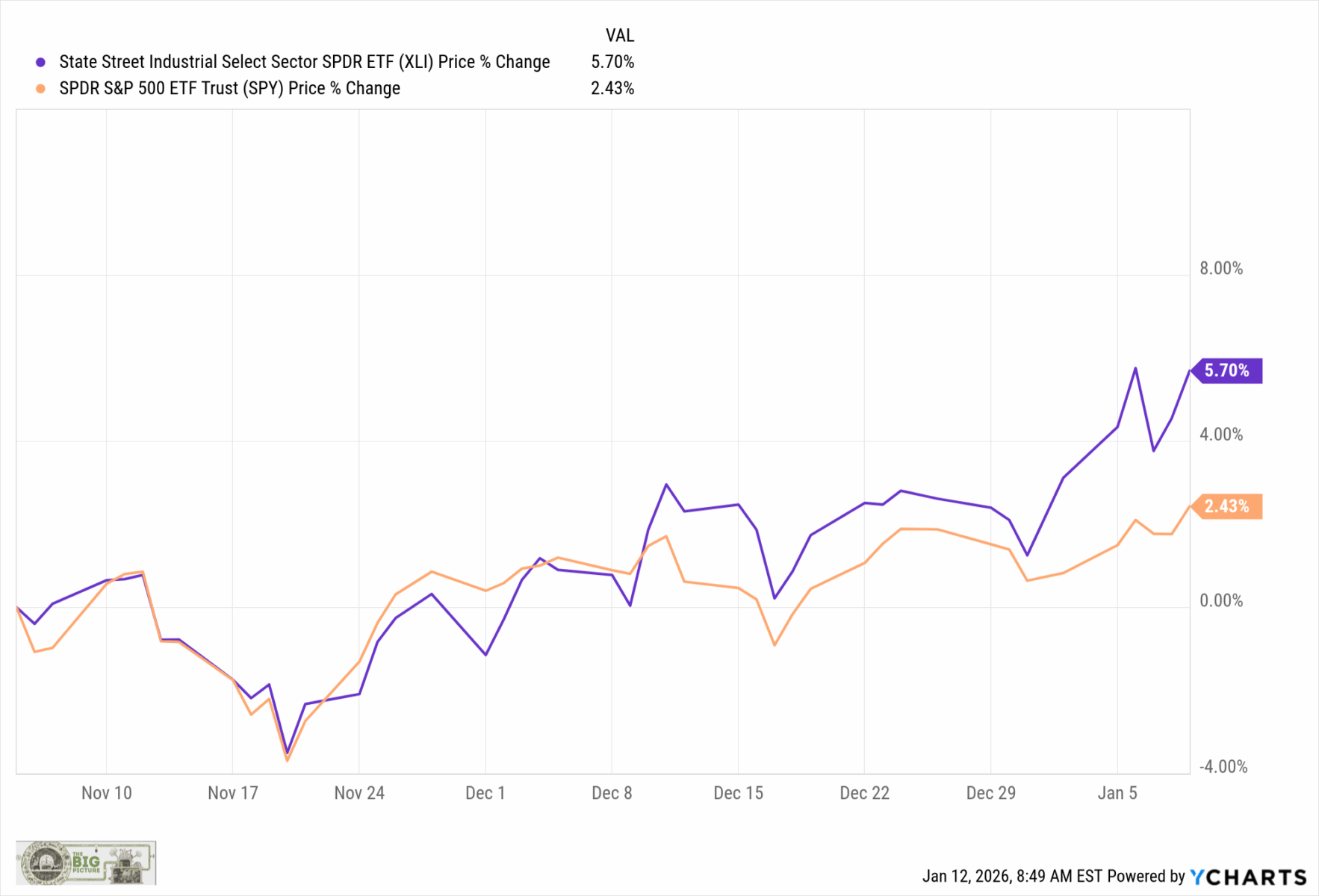

Animal Spirits: Tax the Billionaires

Posted January 7, 2026 by Ben Carlson Today’s Animal Spirits is brought to you by Ycharts: This episode is sponsored by YCharts. Subscribe to YCharts’ Advisor Pulse, LinkedIn newsletter here And start your free YCharts trial through Animal Spirits (new customers only) here. On today’s show, we discuss: Listen here: Charts: Recommendations: Tweets/Bluesky pic.twitter.com/Wlq64SpNyf — […]

-

10 Tuesday AM Reads – The Big Picture

My morning train WFH reads: • Behind every influencer is an army of the influenced, many adrift in debt and mass-produced clutter. The platforms need influencers and influencers need audiences — but what the influenced need is not so simple. (The Verge) • Was Venezuela an Inside Job? All the questions and conspiracy theories you […]

-

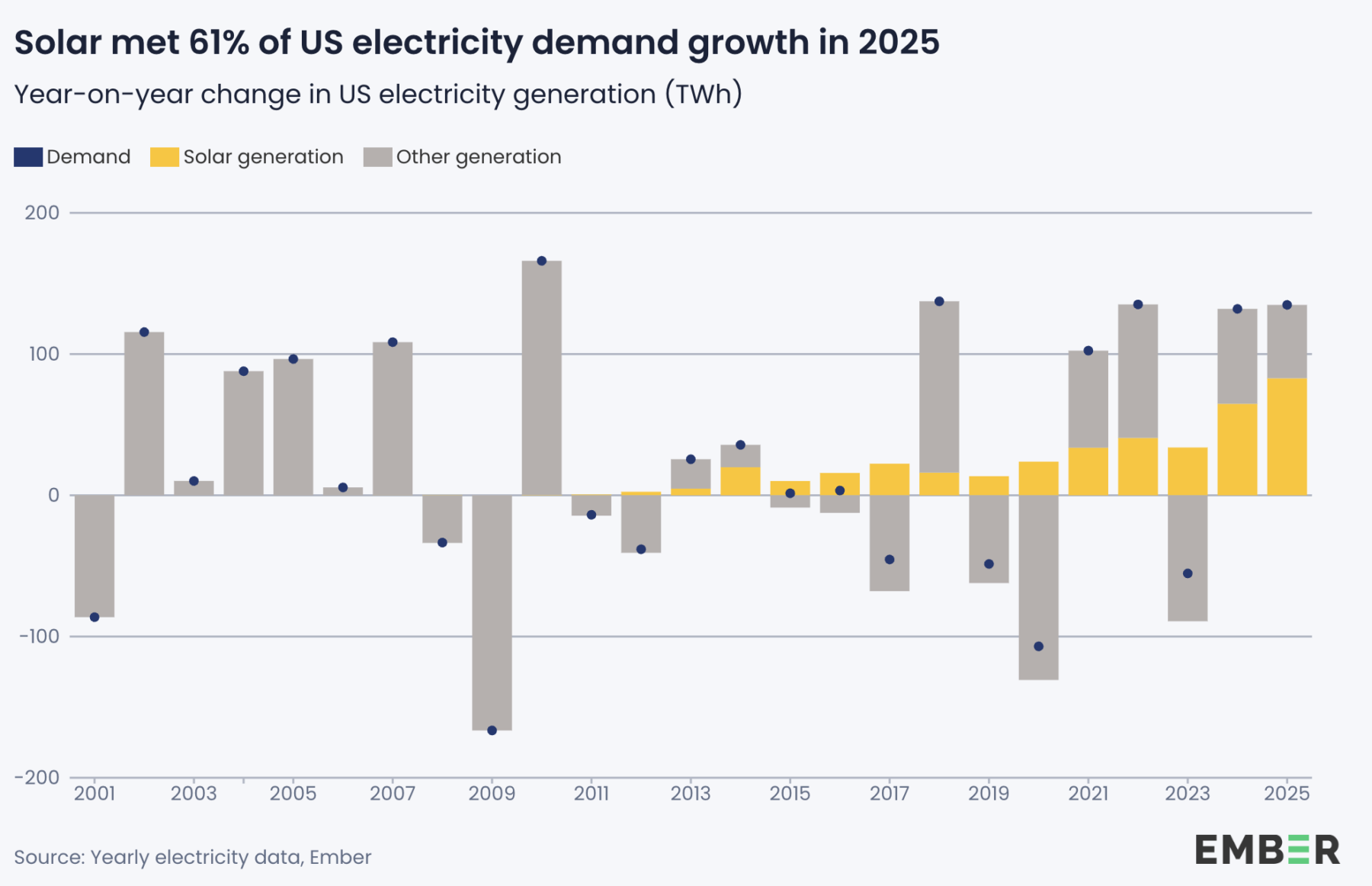

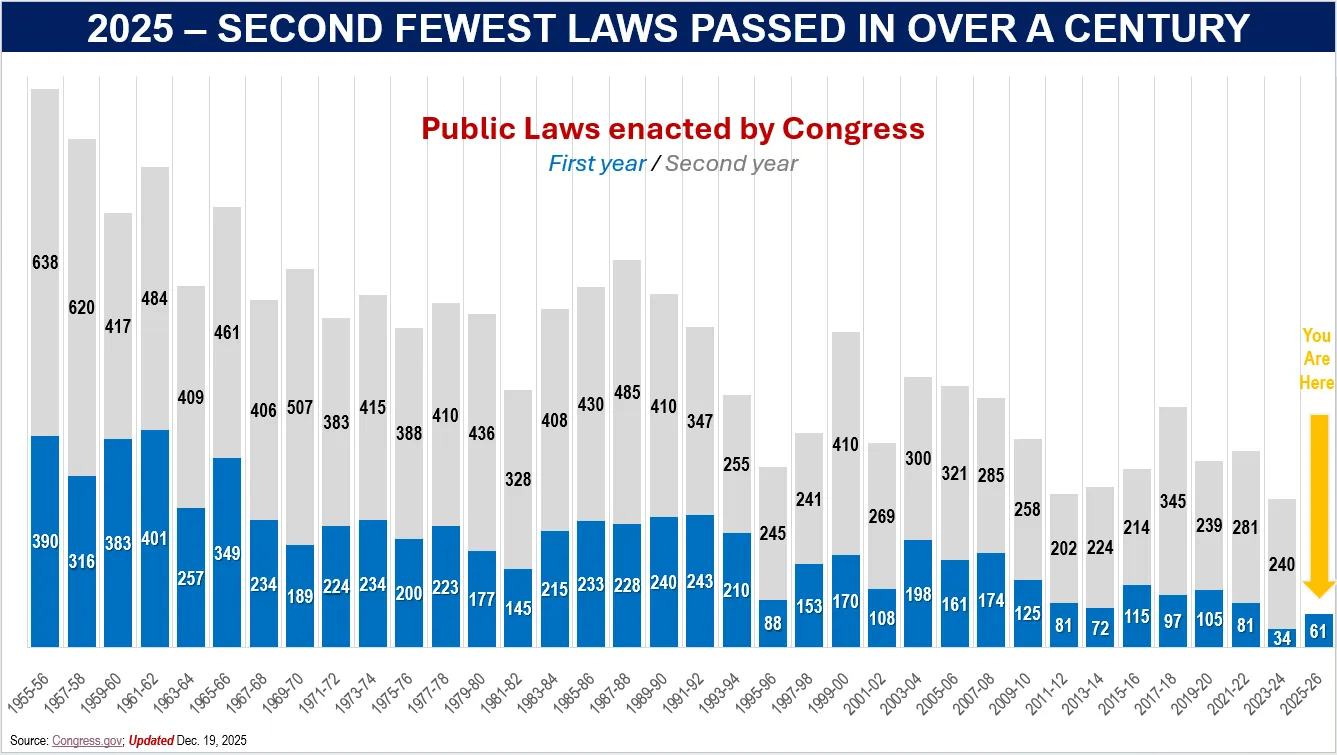

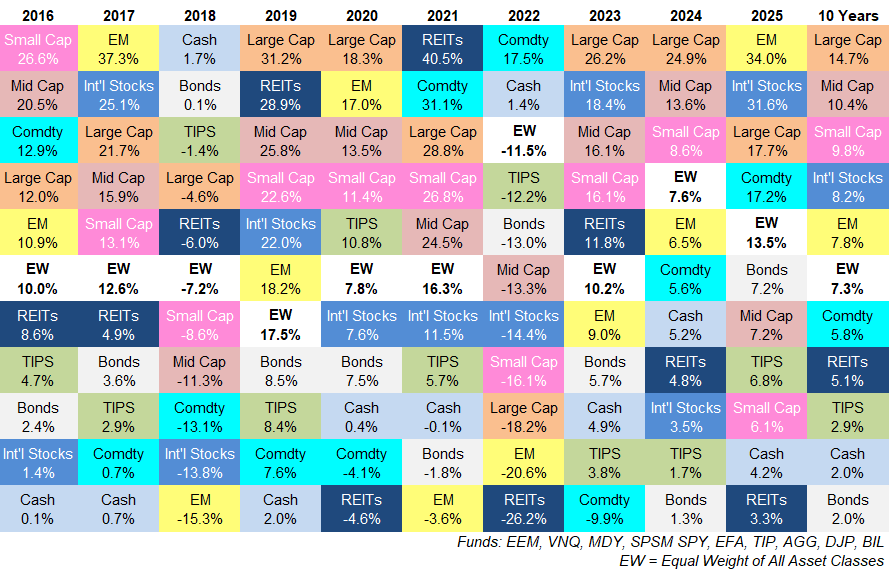

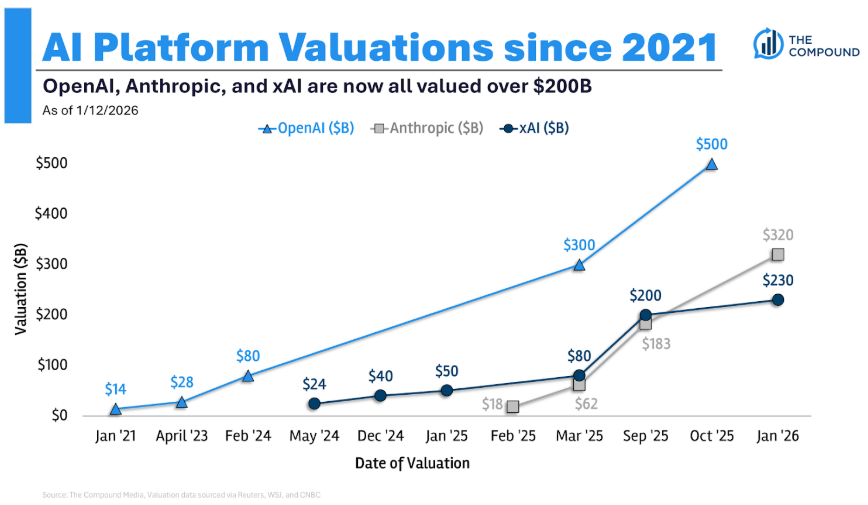

6 Surprises From 2025 – A Wealth of Common Sense

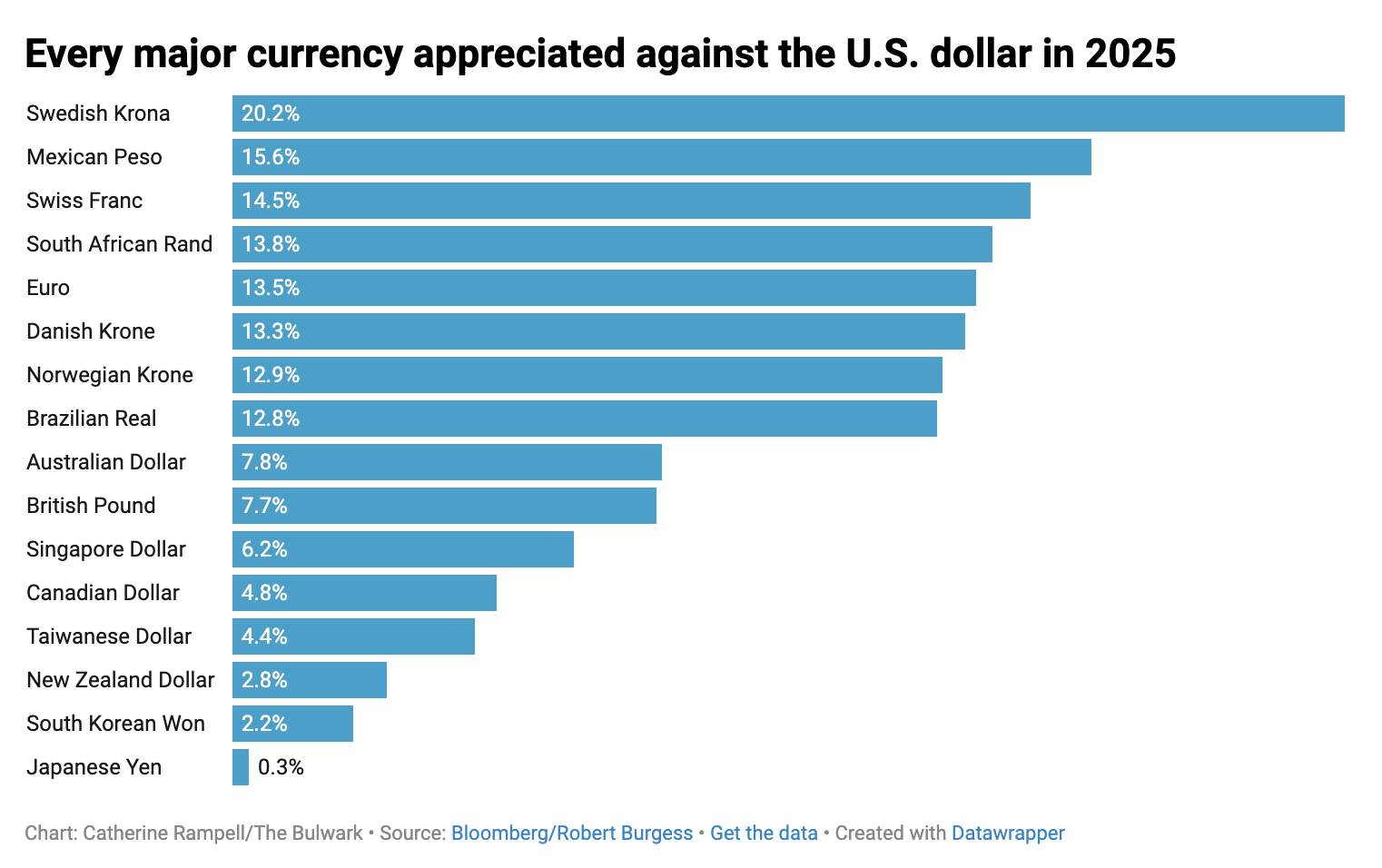

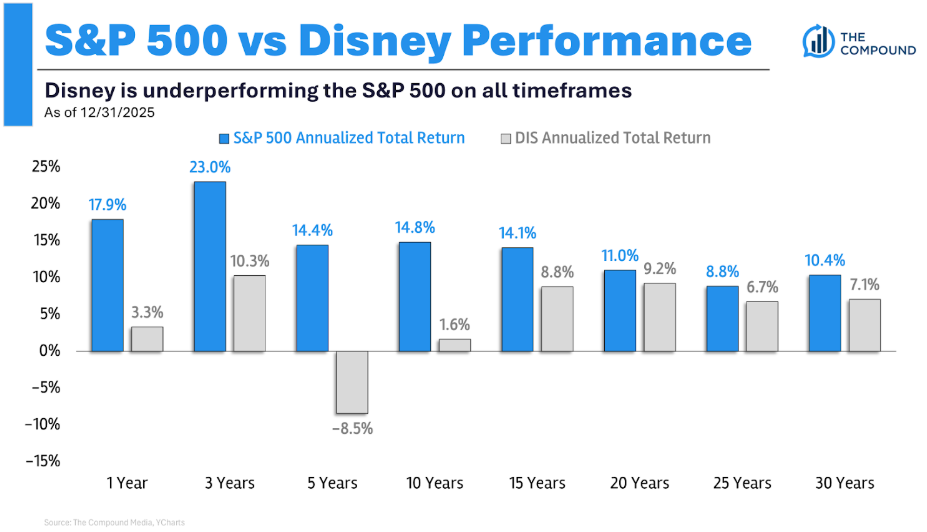

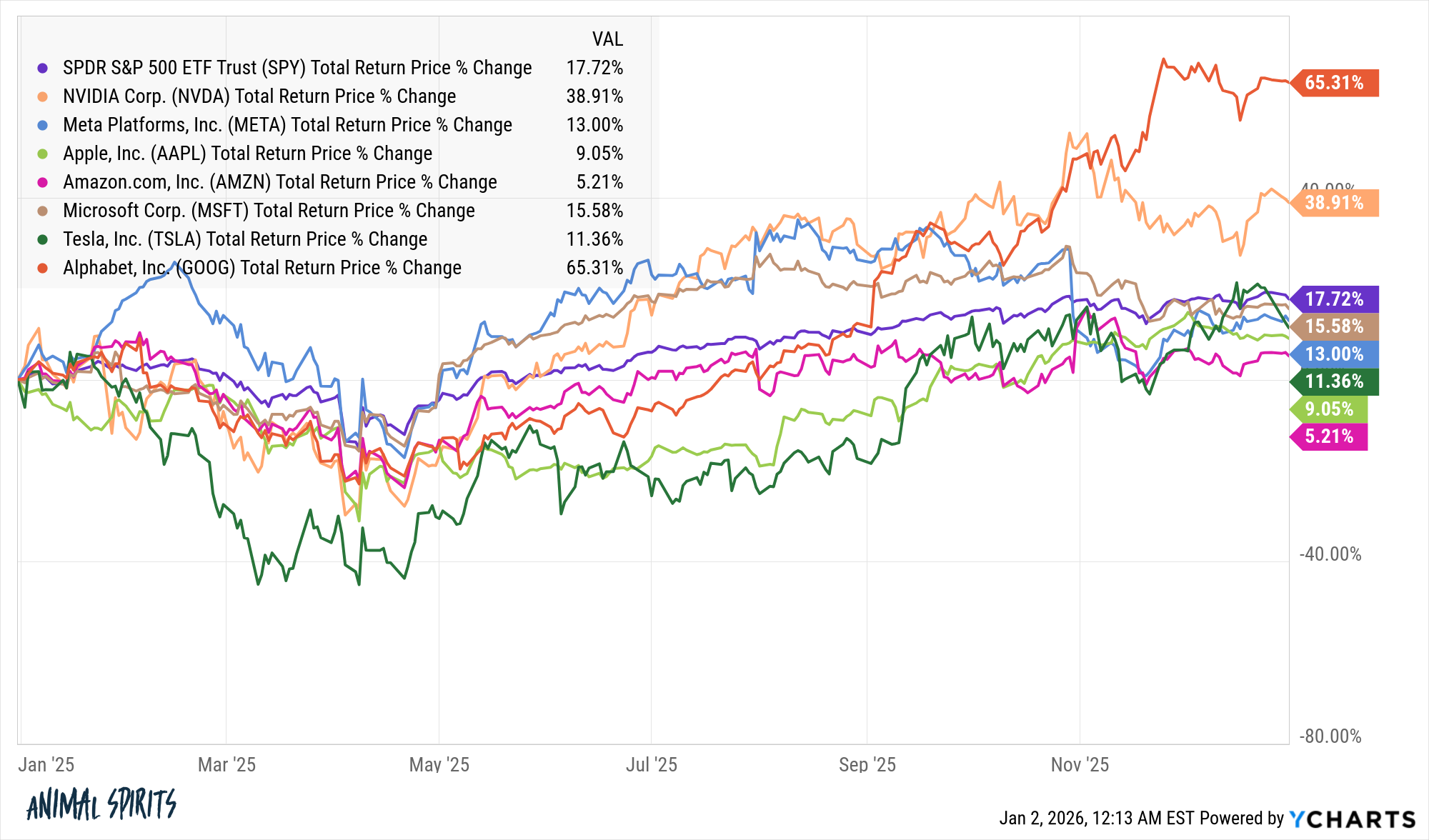

An old boss of mine used to say, “It’s OK to be surprised by what happens in the markets. Just don’t be surprised that you’re surprised.” Here are some things that were surprising in 2025: 1. Just two of the Mag 7 stocks outperformed the S&P 500. Only Google and Nvidia beat the market in […]