Last week’s Sturgeon’s Corollary generated a bit of pushback. The most relevant questions were about ETFs as a group: “Surely, 90% of all ETFs are not crap” was a theme.

Do the math: As of last count, there are 4,297 ETFs; as a comparison, there are only ~3,500 publicly traded equities (but ~2 million unique CUSIPs for Bonds).

But the basic idea that “Most issuances of mainstream financial instruments are mediocre” remained unchallenged. Expand that to adjacent and/or speculative investments, and the stark reality presents itself. In Crypto, there is Bitcoin and Ether, followed by 1,000s of other tradeable blockchain issuance collectively known as “Shitcoins.” If you lose money on a product best described by a phrase with literally “shit” in its name, who else can you blame but yourself?

Which brings me to the late, not-so-great, tradeable assets known as NFTs…

~~~

A quick refresher:

Non-fungible tokens (NFTs) are unique digital tokens issued on a blockchain – think of them as certificates of ownership built on infrastructure such as Ethereum. During the pandemic, with people bored at home and sitting on idle capital, traders (aka degenerate gamblers) were swept up into a speculative frenzy.

Leading the charge were the Crypto Bros, flush with newfound wealth. Other speculators — and more than a few Main Street degens — bought into the hype, following the fervor. People who had no business wagering with 10,000 or 20,000 dollars dived in. And so NFTs became lottery tickets with all the hallmarks of a classic psychological bubble: a new product of dubious fundamental value, rapid price surges, celeb endorsements, and fawning media attention, all of which combined to push prices sky-high.

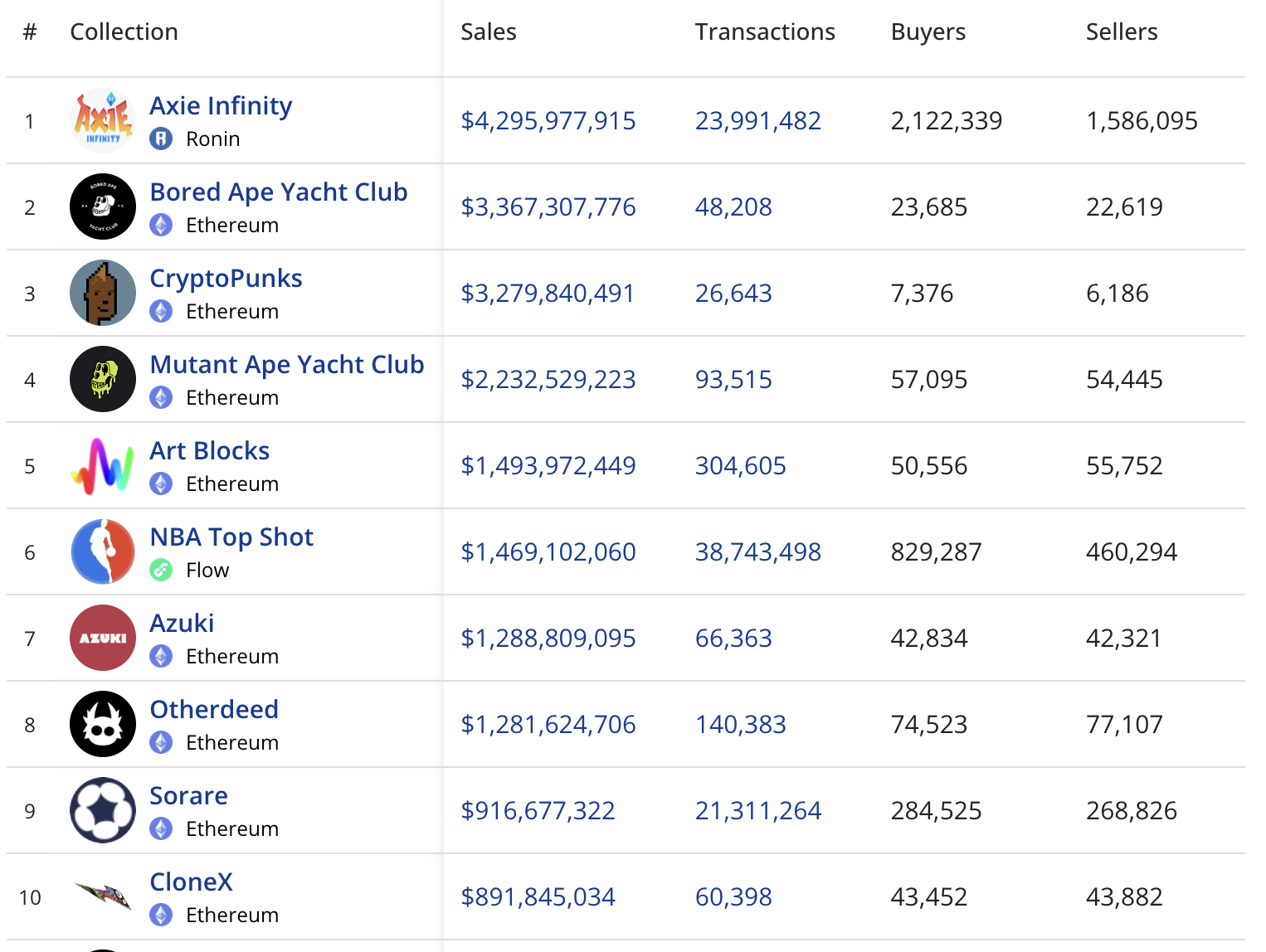

The NFT peak sale was The Merge by Pak, which on December 2, 2021, traded hands at an astonishing $91.8 million. That was preceded by Beeple’s Everydays: The First 5000 Days, auctioned for $69.3 million at Christie’s. Beyond single pieces, there were eight collections of NFTs whose issuances surpassed a billion dollars, according to CryptoSlam. Notable issuers include Axie Infinity at $4.3 billion; Bored Ape Yacht Club at $3.4B; CryptoPunks at $3.3B; Mutant Ape Yacht Club is $2.2B; #6 is the NBA Top Shot at $1.5B.

Adding up the top 100 collections shows a total of $39.2 billion in sales.1

All of the above raises an obvious question: How did so much capital get deployed into something with (arguably) zero intrinsic value?

I understand the unique status of joining an exclusive club, and the ability to authenticate ownership of unique luxury goods, from Hermès Birkin bags to concert tickets – but the shift from useful tool to speculative mania was a very short trip. This was a pure FOMO-based bubble, much more akin to the Dutch Tulip frenzy than anything else in recent years. It was a huge misallocation of capital for individuals, and collectively, a waste of $50 billion. Say what you will about the AI Capex frenzy, it looks almost rational in comparison to the NFT boom and bust.

It is true: most of the SPACs, Hedge funds, ETFs, NFTs, Shitcoins, and even Equities that trade are not worth your time. Still, we are all fascinated by the game. My solution has been to use a cowboy account to satisfy the inner degenerate gambler in all of us; the goal is to keep those demons away from your real money and accounts.

Modern history is filled with all sorts of booms and busts, along with the occasional true bubble. NFTs are a textbook example of what happens when degenerate speculation runs amok…

Previously:

Sturgeon’s Corollary (December 4, 2025)

A Short History of Bubbles (October 24, 2025)

10 Quotes That Shaped My Investment Philosophy (October 2, 2023)

Why Most SPACs Suck (October 26, 2020)

90% of Everything is Crap (July 25, 2013)

RealTime Bubble Checklist (October 16, 2025)

See also:

Is It a Bubble? (Oaktree, December 9, 2025)

How much is the NFT market worth (Coinledger, September 4, 2025)

Why 98% of 2024 NFT Drops Are Dead DewFi Planet, 14 December 2024)

NFT Market Faces 19% Decline in 2024 as Investors Shift to Cryptocurrencies: (AI Invest Jul 8, 2025)

NFT Market 2025 Update (SCB10x, March 27, 2025)

How much is the NFT market worth? (CoinLedger, August 2025)

__________

1. More precisely, $39,243,490,966 via Cryptoslam.

The post Whatever Happened to NFTs? appeared first on The Big Picture.