Komplete Investments LLC

At Komplete Investments, capital management begins with understanding context. Markets change, objectives evolve, and risk is rarely static. Our role is to provide disciplined oversight that adapts to these realities while remaining anchored in long-term priorities. We focus on structure, informed decision-making, and continuity across market cycles so capital is managed with clarity rather than reaction.

We focus on clarity over complexity.

Capital decisions are guided by structure, risk alignment and long term objectives.

Every strategy is built with purpose, patience and measured exposure.

Capital management is not a one-time decision.

Portfolios require ongoing oversight, disciplined adjustments and alignment with changing economic conditions.

Market Perspective

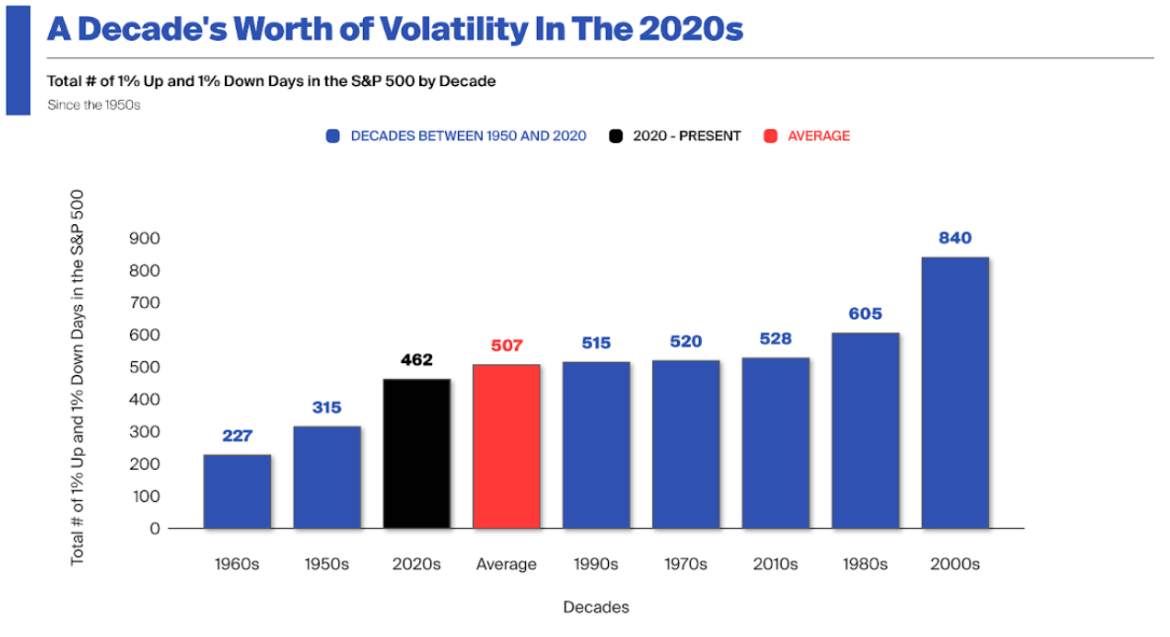

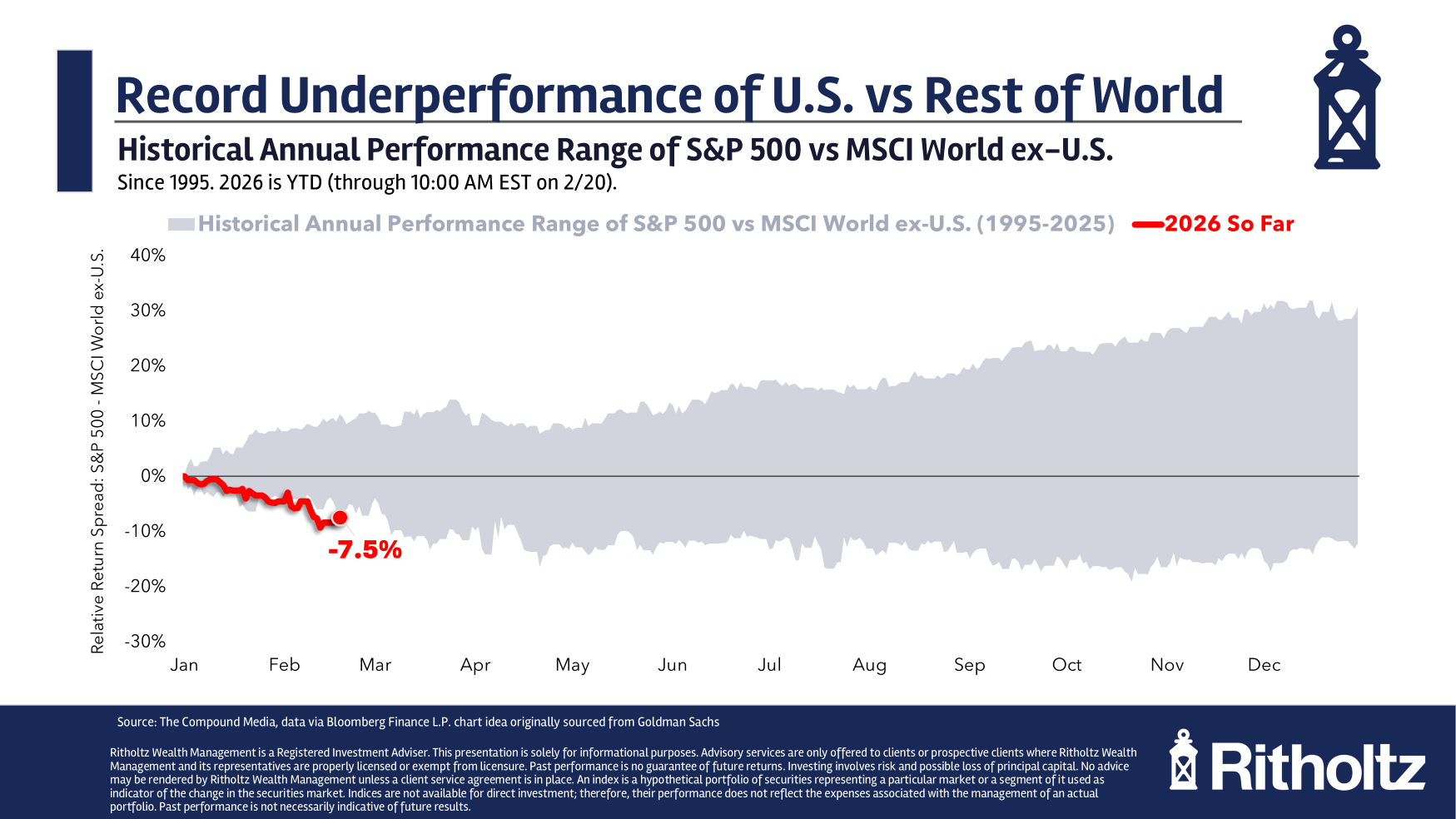

Current markets reward patience more than prediction. Volatility, policy shifts, and global economic pressure have made short-term signals unreliable and reactive decision-making costly. In this environment, capital preservation and measured deployment depend less on timing and more on structure. Understanding how macro forces influence asset behavior over time allows portfolios to remain resilient even when conditions feel uncertain.

At Komplete Investments, market perspective is not built on headlines or forecasts. It is developed through continuous analysis of economic indicators, liquidity conditions, and structural trends that shape risk across cycles. This perspective informs how capital is positioned, adjusted, and protected, ensuring decisions remain grounded in context rather than noise.

Strategic Discipline

Long-term results are rarely the outcome of singular decisions. They are the result of consistent discipline applied across changing conditions. Strategic discipline means knowing when to act, when to wait, and when restraint is the most valuable decision available. It requires frameworks that guide behavior during both opportunity and disruption.

Komplete Investments applies disciplined oversight to ensure capital strategies remain aligned with defined objectives as circumstances evolve. This includes regular evaluation of exposure, thoughtful adjustments when warranted, and continuity in decision-making across market cycles. The goal is not to react faster than the market, but to act with clarity and intention when it matters most.

Komplete Investments Corporate Updates

K.I. approaches growth as a deliberate, structured process — guided by long-term objectives rather than short-term momentum. Each initiative considered by the firm is evaluated through the lens of capital stewardship, operational viability, and strategic alignment. Rather than signaling intent through projections or commentary, K.I. prioritizes action supported by governance, due diligence, and sustained oversight. This approach ensures that expansion reflects readiness and discipline, not acceleration for its own sake.

The updates below highlight recent milestones and active initiatives that demonstrate this philosophy in practice. From governance and information infrastructure to strategic partnerships and sector engagement, these developments reflect measured progress across multiple fronts. Together, they offer insight into how K.I. continues to build responsibly — pairing forward-looking strategy with tangible execution.

Advisory Board

The completion of our advisory board marks a foundational milestone in the firm’s long-term growth strategy. This board was assembled with intention — prioritizing experience, regulatory understanding, and sector depth over visibility or volume. Each advisor contributes specialized expertise across finance, operations, governance, and market analysis, ensuring that decision-making is informed by multiple perspectives and grounded in real-world execution. Rather than serving as a symbolic layer, the advisory board is actively integrated into strategic review, risk assessment, and forward planning initiatives.

This structure allows the firm to remain agile while maintaining institutional discipline. As market conditions evolve and new opportunities emerge, advisory oversight provides a stabilizing framework for evaluation and alignment. The result is a governance model that supports thoughtful expansion, protects capital interests, and reinforces accountability at every level of operation. For clients and partners, this milestone reflects a commitment to measured leadership and sustained excellence — not growth for growth’s sake, but progress guided by experience.

MTD Acqusition

The acquisition of MTD represents a strategic investment in information access, market awareness, and editorial independence. In an environment where financial narratives often prioritize immediacy over accuracy, ownership of a dedicated finance news platform enables a more controlled and thoughtful approach to market intelligence. MTD operates as an independent media property, focused on delivering timely financial coverage, economic insights, and industry analysis without external influence or promotional bias.

Beyond content distribution, the acquisition strengthens internal research capabilities and enhances visibility into emerging financial trends. By maintaining a direct relationship with financial reporting and analysis, the firm deepens its understanding of market sentiment, policy shifts, and economic signals that influence investment decision-making. This alignment between media intelligence and capital strategy reinforces the firm’s emphasis on informed, data-driven oversight — ensuring that investment perspectives remain current, contextual, and strategically grounded.

Transportation Sector Engagement

K.I. is currently engaged in extended discussions with a transportation-focused company as part of a broader evaluation of essential service infrastructure opportunities. These conversations are exploratory in nature and centered on understanding operational frameworks, regulatory environments, and long-term demand stability within the transportation sector. Rather than approaching the space from a speculative or rapid-entry standpoint, K.I. is prioritizing alignment, scalability, and governance considerations before advancing any formal commitments.

Transportation remains a foundational component of economic activity, intersecting with urban development, workforce mobility, and commercial logistics. By maintaining active dialogue with established operators, K.I. continues to assess how capital, oversight, and strategic structure can contribute to sustainable growth in this sector. Any future involvement will be guided by disciplined analysis and measured deployment, ensuring that participation supports long-term objectives and adheres to the firm’s standards for operational readiness and capital stewardship.

Client Value & Approach

Engagement with K.I. begins with an understanding of objectives, constraints, and strategic priorities. Each relationship is evaluated individually to ensure alignment, suitability, and long-term viability. Initial inquiries allow for a focused review of needs and determine whether collaboration is appropriate.

- Capital allocation strategy

- Risk alignment and exposure management

- Portfolio structure and oversight

- Long-term growth planning

- Preservation and continuity considerations

- Market and economic assessment

- High-net-worth individuals

- Private entities and holding companies

- Family offices and generational wealth

- Entrepreneurs with liquidity events

- Clients seeking ongoing oversight

- Capital requiring structured management

Want to expand your message by purchasing ad space on Komplete Investments?

-

All of the Jobs That No Longer Exist

Heading into the 19th century, about 70-80% of all jobs in the industrial world were in agriculture. Most people were farmers. By 1870, more than half of all men owned or performed labor on farms. Today less than 1% of the U.S. population works in agriculture. Innovation and technology made farming more efficient, so people […]

-

RWM Coming to San Francisco April 14-16

I am very excited to announce that RWM is coming to San Francisco, California, on April 14th. Our relationship with the City by the Bay goes back to the early days when Josh, Kris, Michael and I would spend a few days here meeting clients. The tech center of the world is filled with […]

-

Animal Spirits: Everyone Hates AI

Aim beyond the horizon with our active muni ETFs Navigating today’s complex muni universe requires precision, and index strategies can fall short. Our solution: the industry’s largest active muni ETF lineup–national ETFs and seven single-state ETFs, all fueled by our deep expertise. Learn More Today’s Animal Spirits is brought to you by Betterment Advisor Solutions […]

-

Part II: IEEPA Tariff Ruling’s Losers

This is Part II; Part I was published here Friday Soon after the Supreme Court dropped its IEEPA decision Friday morning, I wrote up a post on who the IEEPA decison Winners were. Today, as promised, we review the losers. Spoiler alert: there are a lot of them. In broad strokes, […]

-

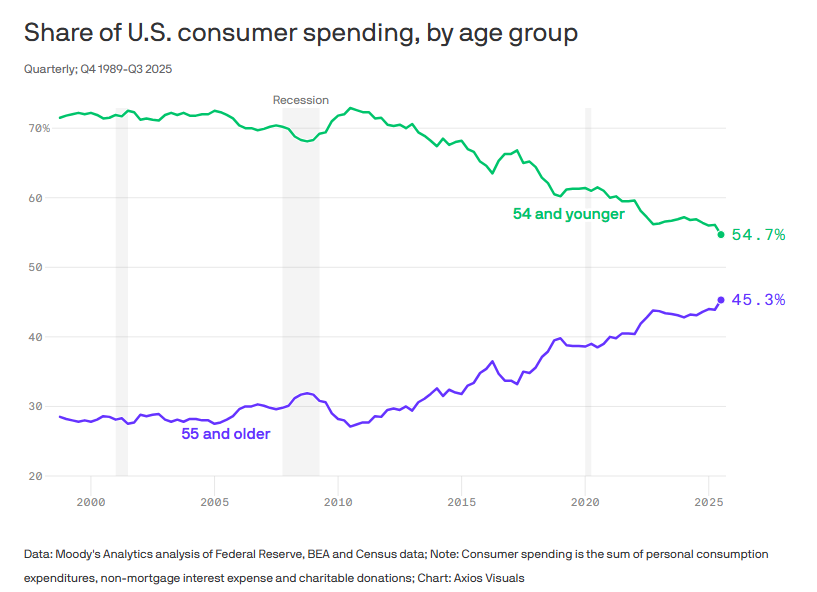

Rich Old People – A Wealth of Common Sense

Older people are having a moment in the economy. According to Axios, people 55 and older now make up more than 45% of spending in America: The Wall Street Journal shows that the 70 and over crowd now controls around a third of the net worth: Those 55 and older control almost three-quarters of the […]

-

Winners & Losers of SCOTUS Decision Striking Down Tariffs

SCOTUS: Article I, Section 8, of the Constitution specifies that “The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises.” The Framers recognized the unique importance of this taxing power—a power which “very clear[ly]” includes the power to impose tariffs. Gibbons v. Ogden, 9 Wheat. 1, 201. And they […]

-

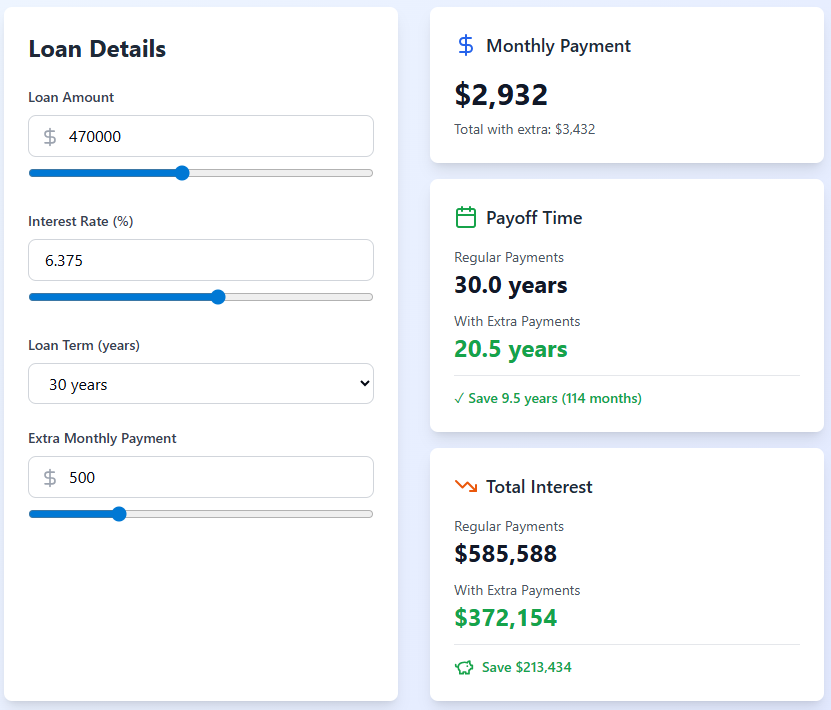

Early Mortgage Payments or Invest in the Stock Market?

A reader asks: There are lots of financial rules of thumb out there. Do you have a rule of thumb for when to prioritize paying down a mortgage instead of investing? I have a rate at 6.375% for $470,000 and I am 30 years old. How should I be thinking about this? I love […]

-

Transcript: Douglas and Heather Boneparth, Money Together

The transcript from this week’s, MiB: Douglas and Heather Boneparth, Money Together, is below. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts, Spotify, YouTube, and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here. ~~~ Interview with Doug Boneparth and […]

-

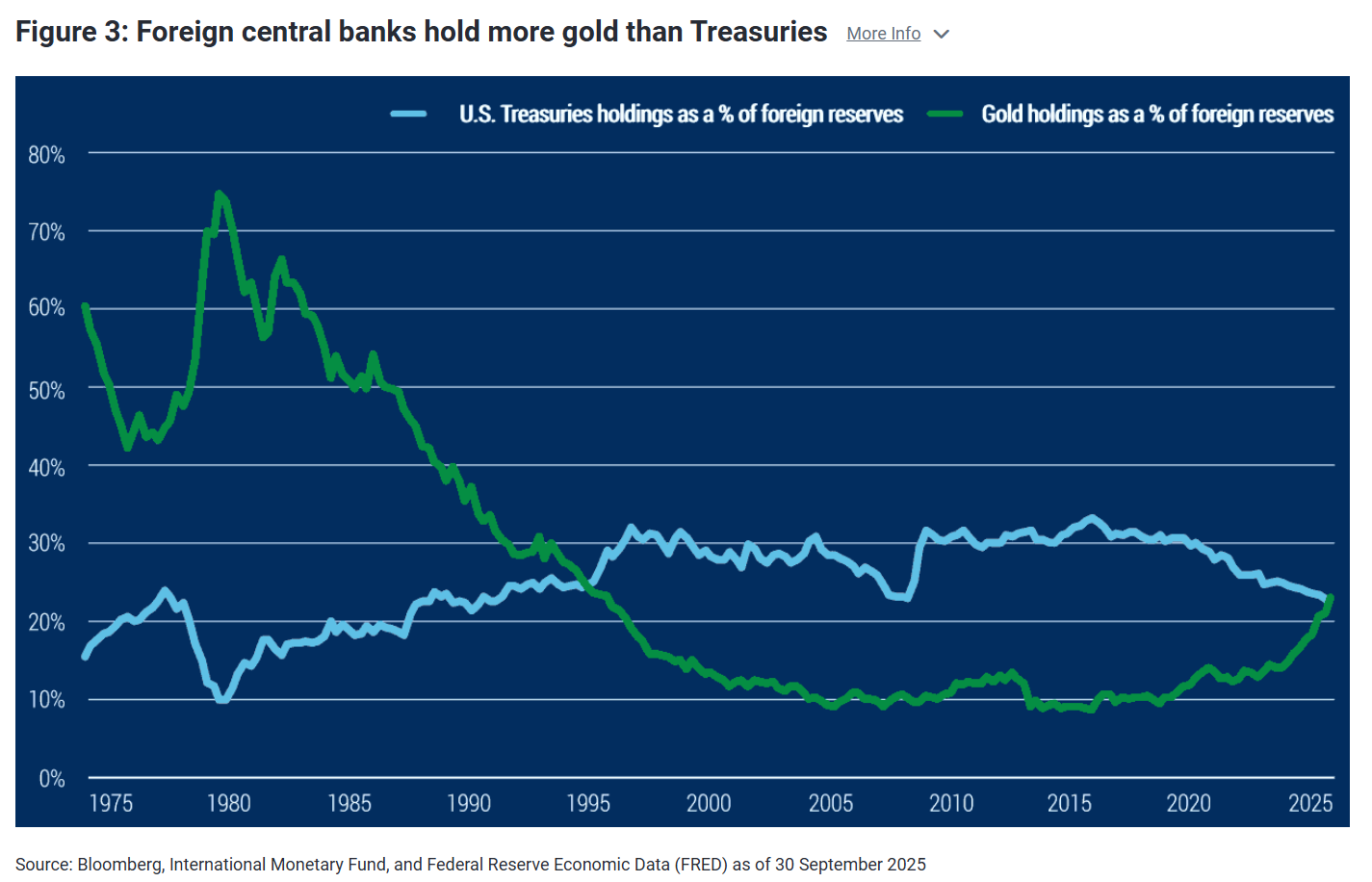

Talk Your Book: Why Commodities Are Working

Posted February 16, 2026 by Ben Carlson Today’s Talk Your Book is brought to you by PIMCO: Click here to learn more about PIMCO, and the PIMCO Commodity Strategy Active Exchange-Traded Fund (CMDT) On today’s show, we discuss: How PIMCO aims to generate alpha in the commodities space through active management The role that […]

-

MiB: Douglas and Heather Boneparth, Money Together

Valentine’s Day Special! This week, I speak with Douglas and Heather Boneparth. Doug is the president of Bone Fide Wealth and Heather is the firm’s Director of Business and Legal Affairs and Chief Compliance Officer. They also discuss their new book “Money Together.” They discuss the challenges couples can face discussing their finances, […]

-

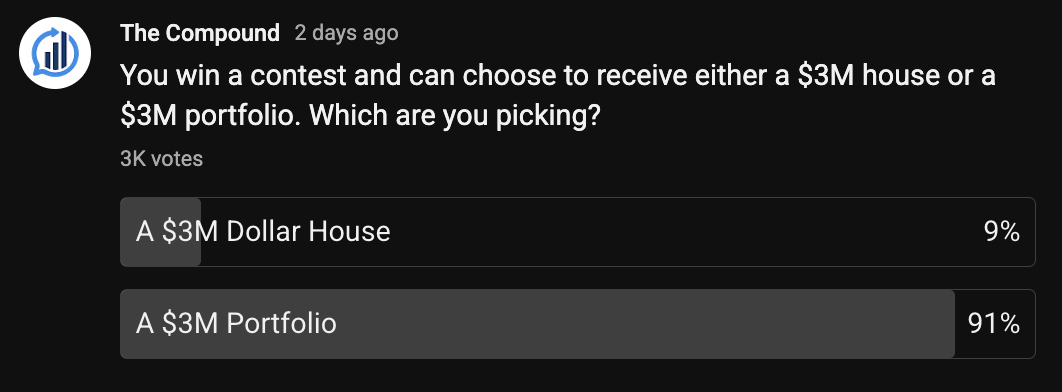

Would You Rather Have a $3 Million House or a $3 Million Portfolio?

My colleague Nick Maggiulli posed a rhetorical personal finance question last week: He’s right of course. Big houses, luxury automobiles, nice boats, fancy clothes, expensive vacations, etc., these are status symbols. Portfolio wealth is what you don’t see — the money saved, invested and not spent. I am in total agreement with Nick that we […]

-

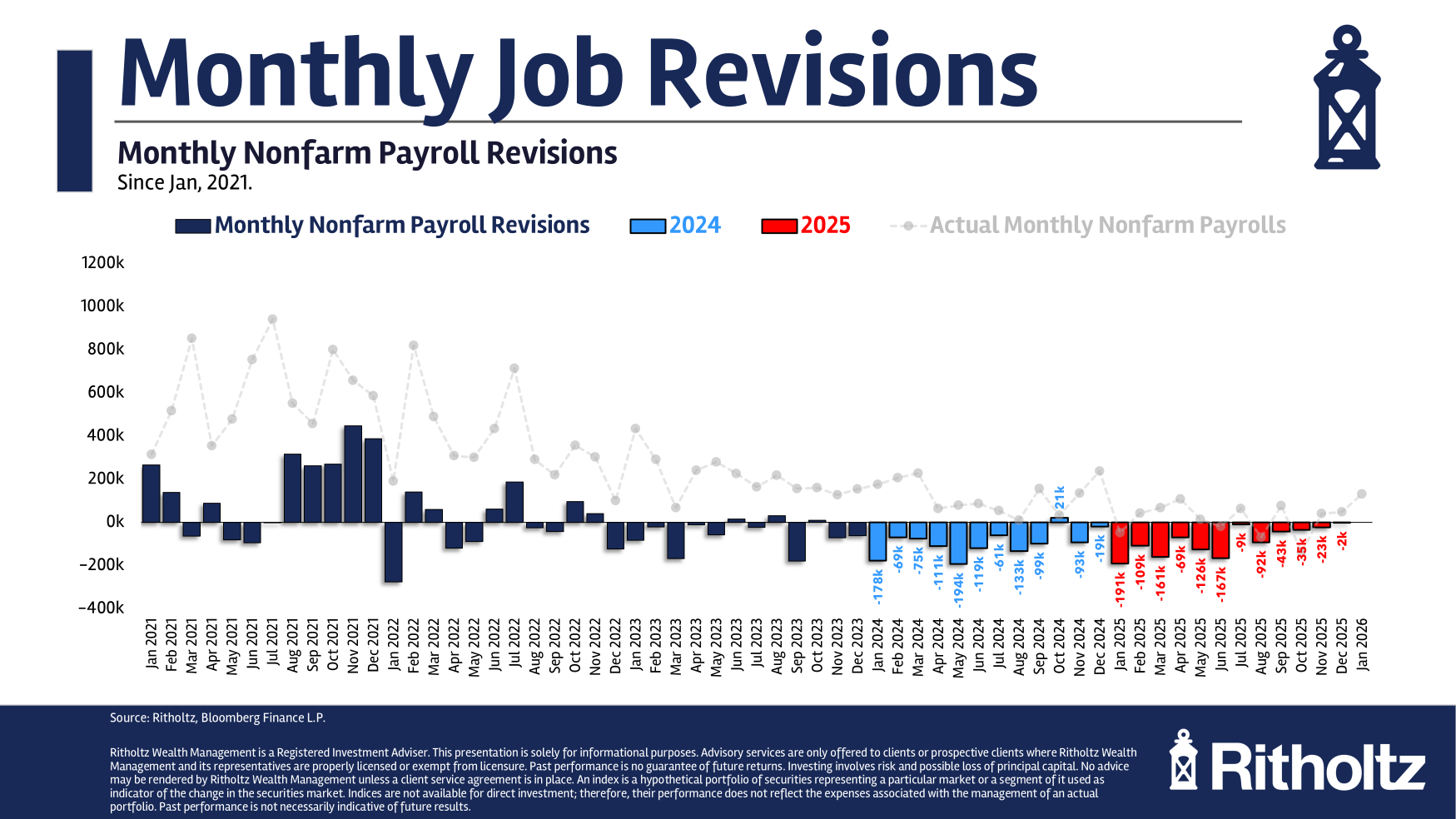

NonFarm Payrolls, Confirmation Bias edition

Today’s (belated) nonfarm payroll report had a little something for everyone. Whether you are bullish or bearish, recession or expansion, MAGA or Never Trump, there were nuggets of data in the report for you. My charge is to put this into a broader context minus the bias. Let’s jump into the specifics: The […]